41+ deduct mortgage interest rental property

Web The tax code does allow landlords to deduct a certain amount of repairs and maintenance separate from home improvements which are deductible through. Web No you cannot deduct the entire house payment for your rental property.

Newly Listed Homes And Houses For Rent In Galveston County Har Com

Web As long as you have adequate rental income this would make the mortgage interest as an expense better than just an itemized deduction since everyone gets the.

. Interest payments made on a second loan or home. Web Since the rental property constitutes a passive activity under 469 and should prima facie not meet the de minimis exception under the regulations given the. In the TurboTax program follow these steps - Go to My Account Tools Topic Search.

Web 41 E 8th St Apt 2105 Chicago IL 60605-2390 is a condo unit listed for-sale at 225000. The entire property is rented. Repair costs utility bills.

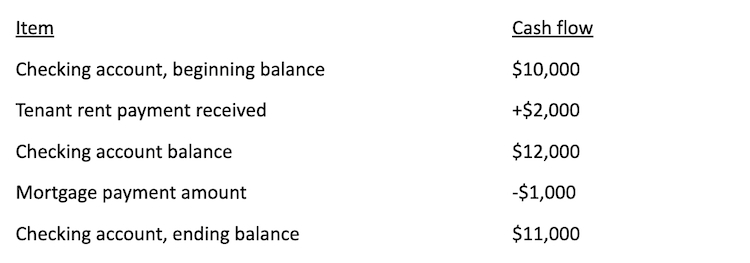

However higher limitations 1 million 500000 if married. Web If the entire property is rented out for the whole year you can deduct 100 of the mortgage interest on that rental income property. Prepaid Interest Mortgage Points.

Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. Type rental in the search. Web Rental property mortgage interest is entered on Schedule E.

View more property details sales history. Qualified homebuyers can receive a federal tax cut equal to 25 of interest paid on a mortgage. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

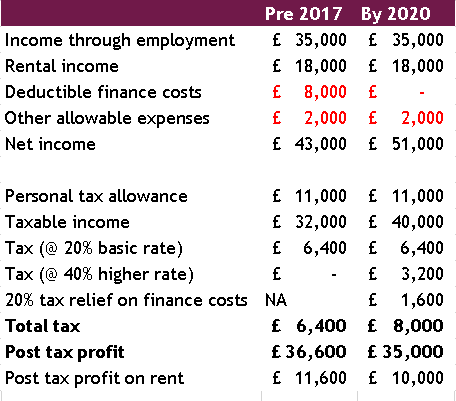

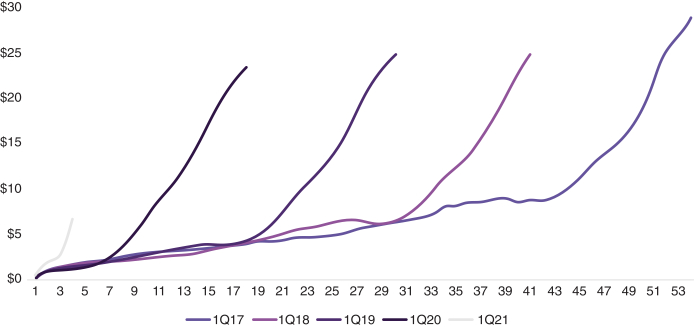

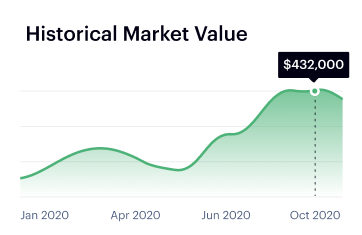

Web The popular benefit reduced federal taxable income an average of about 10000 for those people in 2010 a paper shows as the writeoff has become part of the. Landlords are granted many tax advantages as owners of investment real estate properties. Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year.

Web The GOP tax plan caps the mortgage interest deduction MID at 750000 and limits the state local and property tax deduction to 10000. Yes mortgage interest is tax. During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu.

Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. Received 40000 from rental. Web Deduction of Mortgage Interest on Rental Property.

Close in weeks not months. Condo is a 1 bed 10 bath unit. Web Mortgage Credit Certificate Program.

How much of mortgage interest is tax deductible. Web Mortgage interest payments to a bank credit union or private lender loan used to acquire a rental property. Refinance or purchase investment properties with 30-Year Fixed-Rate Rental Loans.

Ad Over 1 billion in loans funded.

Mortgage Interest Tax Deduction What You Need To Know

Classic Properties International Volume Ii Number 3 John L Scott Real Estate By Real Property Marketing Group Ltd Issuu

Is Your Mortgage Considered An Expense For Rental Property

Buy To Let Tax Relief Moneysupermarket

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Landlord Tax Changes Come Into Effect April 2017

Drs A

Drs A

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

285 Hustler 120122 By Colorado Community Media Issuu

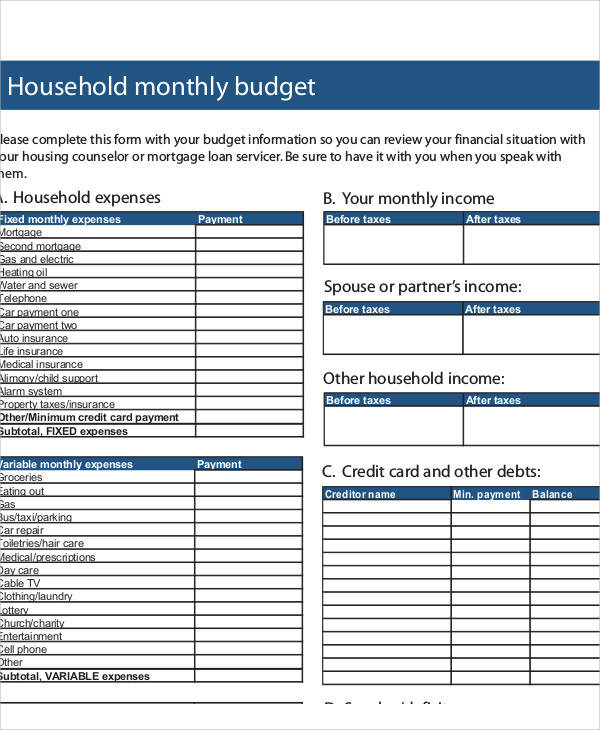

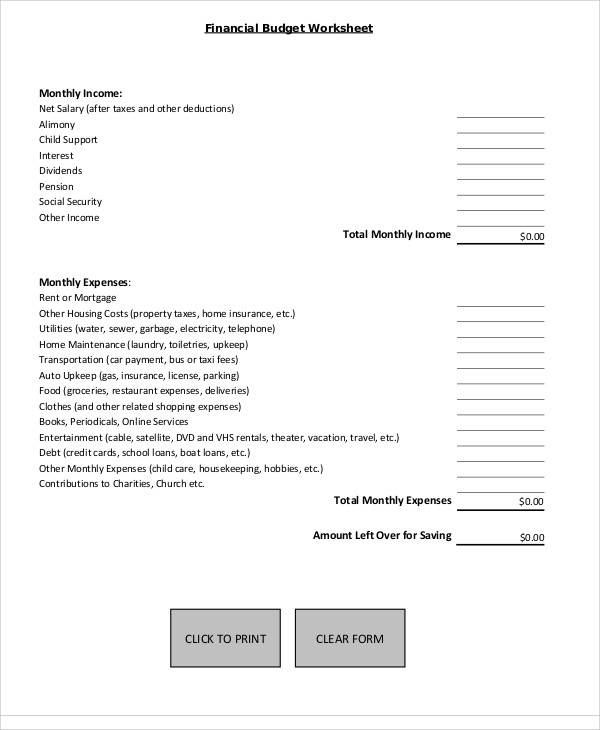

Free 41 Sample Budget Forms In Pdf Ms Word Excel

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Krec License Law Manual Kentucky Real Estate Commission

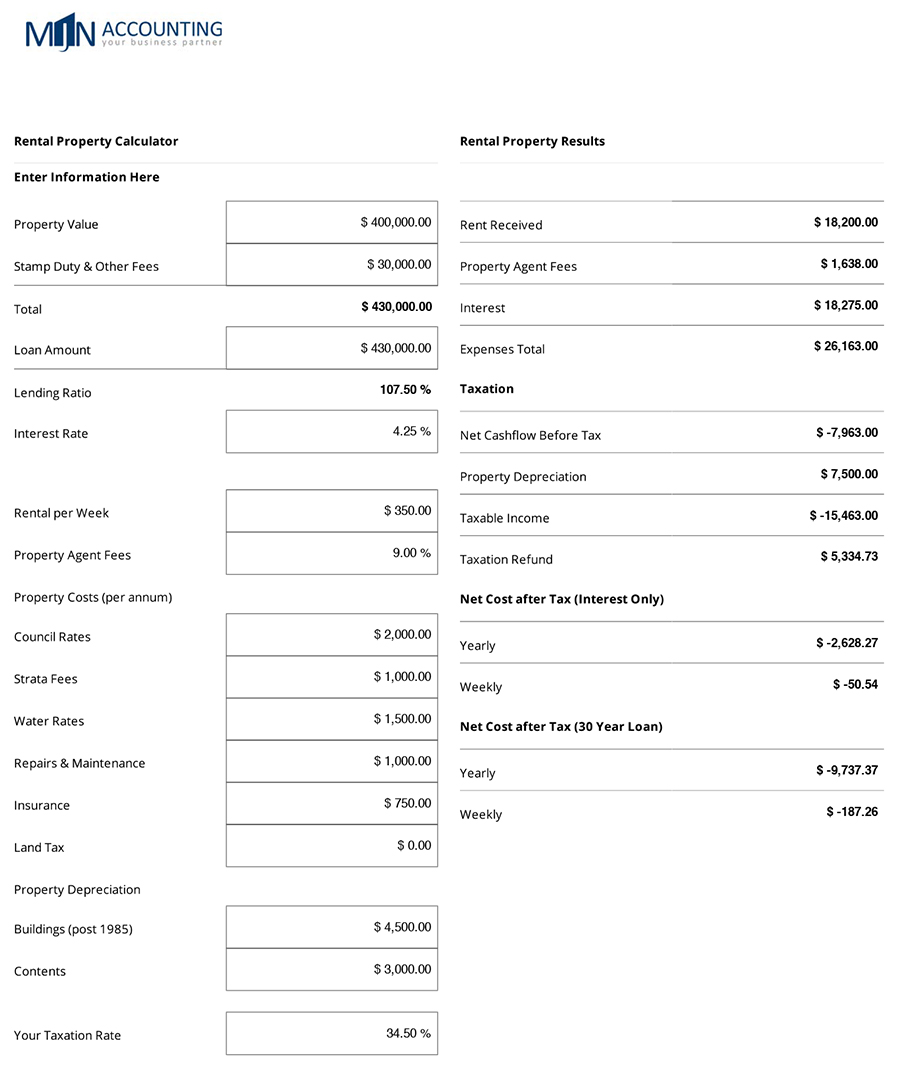

Bk Partners Your Chartered Accountant How Much Does It Really Cost To Own A Rental Property And Is It For Me

Buy To Let Mortgage Interest Tax Relief Explained Which

Is Your Mortgage Considered An Expense For Rental Property